Tax Out Report

Report Module Guide: Tax Out Report

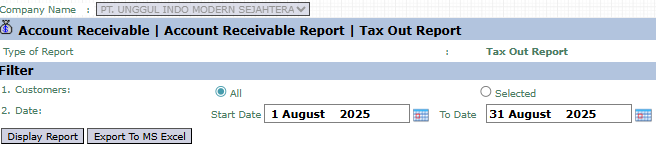

Module Location

Accounts Receivable > Report > Tax Out Report

Module Objective

The Tax Out Report module is used to generate a detailed list of all Output Tax (Output VAT or VAT Out) that originates from sales transactions to customers. This report is an essential component for preparing and filing the Monthly VAT Return (SPT Masa PPN).

1. Report Parameters (Filter)

The main page of this module is a simple form containing several parameters to customize the report that will be generated.

Here is an explanation for each parameter:

-

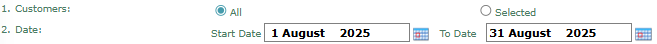

Customers:

-

Select All to include Output VAT transactions from all customers.

-

Select Selected to filter the report to only display data from a specific customer.

-

-

Date:

-

Specify the Start Date and To Date range to define the tax period to be reported (e.g., August 1, 2025, to August 31, 2025).

-

2. Steps to Generate the Report

Step 1: Set Report Parameters

Define the Date range and select the scope of Customers that you want.

Step 2: Generate the Report

After all parameters are set, click one of the two buttons in the bottom-left section of the page:

-

Display Report: To preview the Tax Out report directly on your screen.

-

Export To MS Excel: To download the report data in an Excel file format.

Tips & Important Notes

-

This report is the primary data source for the recapitulation of Output VAT that must be reported in the Monthly VAT Return.

-

To ensure the accuracy of this report, make sure all sales invoices to customers (Sales Invoices in the Sales module) that include VAT have been recorded correctly.

-

This report is a primary tool for the Tax and Customs and Accounting (AR - Account Receivable) teams.

No comments to display

No comments to display