Credit Limit Usage

Report Module Guide: Credit Limit Usage

Module Location

Sales > Reports > Invoice Reports > Credit Limit Usage

Module Objective

The Credit Limit Usage report module is used to generate a report that details the usage of the credit limit by customers. This report displays all outstanding (unpaid) documents that contribute to a customer's total receivable balance, making it easier for the sales and finance teams to manage credit risk.

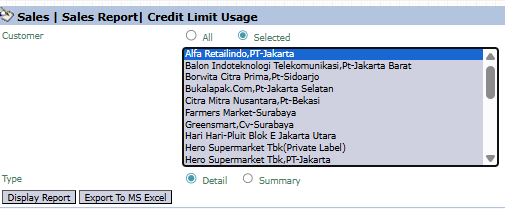

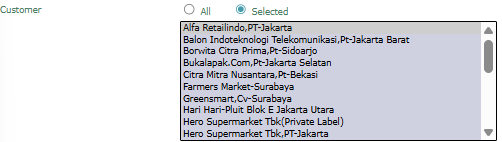

1. Report Parameters (Filter)

The main page of this module is a form containing several parameters to customize the report that will be generated.

Here is an explanation for each parameter:

-

Customer:

-

Filter the report by All customers or a Selected customer that you wish to check.

-

-

Type:

-

Select the report's level of detail:

-

Detail: Displays the details of each outstanding document (invoice, debit/credit note).

-

Summary: Displays a summary of the total credit limit usage.

-

2. Steps to Generate the Report

Step 1: Set Report Parameters

Select the Customer scope and the report Type that you want.

Step 2: Generate the Report

After all parameters are set, click one of the two buttons in the bottom-left section of the page:

-

Display Report: To preview the report directly on your screen.

-

Export To MS Excel: To download the report data in an Excel file format.

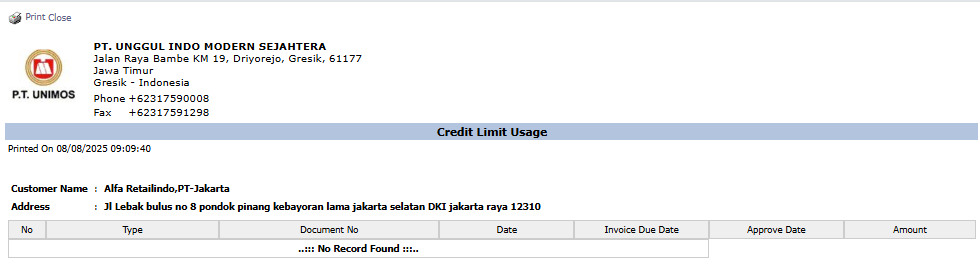

3. Example of the Report View

After you click, the system will generate a detailed report like the following, which details every document that affects the customer's receivable balance.

Report Explanation: This report will display a detailed list of all the documents that make up the customer's total outstanding receivable.

Key Columns:

-

Type: The type of document (e.g., Invoice, Debit Note).

-

Document No: The document's reference number.

-

Invoice Due Date: The due date.

-

Amount: The value of each outstanding document.

Tips & Important Notes

-

Use this report before approving a new Sales Order to ensure a customer does not exceed their approved credit limit.

-

This is an important tool for the Credit Control, Sales, and Accounts Receivable (AR) teams.

-

The accuracy of this report depends on the Credit Limit data being set up correctly in the customer master data or in the Sales Contract / MOU.

No comments to display

No comments to display