PPN Attachment

Report Module Guide: VAT Attachment (PPN Attachment)

Module Location

Accounts Receivable > Report > VAT Attachment

Module Objective

The VAT Attachment (PPN Attachment) report module is used to generate a report that is specifically formatted to be an attachment in the filing of the Monthly VAT Return (SPT Masa PPN). This report summarizes the Output VAT (from sales) transactions that are required for the completeness of the tax documentation.

1. Report Parameters

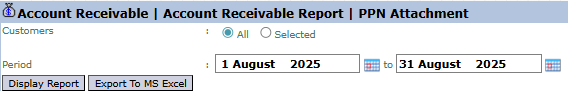

The main page of this module is a simple form containing several parameters to customize the report that will be generated.

Here is an explanation for each parameter:

-

Customers:

-

Select All to include VAT transactions from all customers.

-

Select Selected to filter the report to only display data from specific customers.

-

-

Period:

-

Specify the date range (from and to) to define the tax period to be reported (e.g., August 1, 2025, to August 31, 2025).

-

2. Steps to Generate the Report

Step 1: Set Report Parameters

Define the Period range and select the scope of Customers that you want.

Step 2: Generate the Report

After all parameters are set, click one of the two buttons in the bottom-left section of the page:

-

Display Report: To preview the VAT attachment report directly on your screen.

-

Export To MS Excel: To download the report data in an Excel file format.

Tips & Important Notes

-

This report is specifically designed to meet the tax reporting requirements in Indonesia.

-

Use this report along with other VAT reports to complete the filing of your Monthly VAT Return.

-

The Export to MS Excel feature is very important for this module, as the data in Excel format may be needed for further processing or for uploading to tax systems.

-

This module is a primary tool for the Tax and Customs team.

No comments to display

No comments to display