Skip to main content

Settlement Inbox

Report Module Guide: Deposit Management

Module Location

Finance > Deposit Settings

Module Objective

The Deposit Management module serves as a reporting and inquiry tool for monitoring all deposit transactions. This includes both deposits received from customers (sales down payments) and deposits given to suppliers (purchase down payments). This module provides a centralized list for tracking the amount, usage, and remaining balance of all deposits.

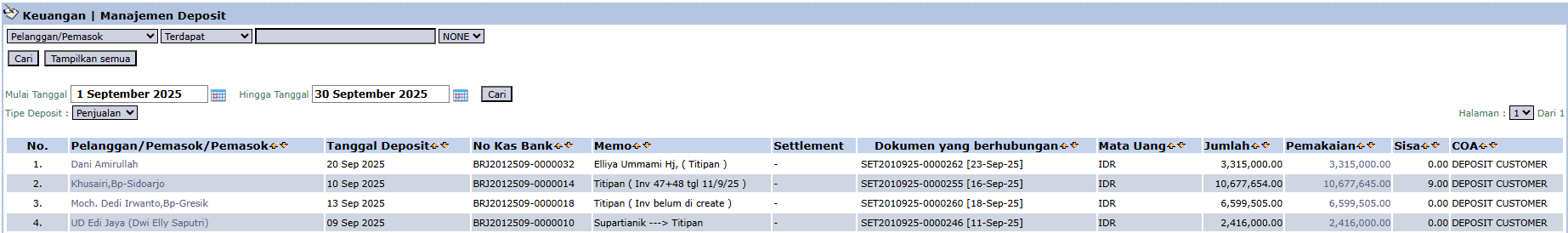

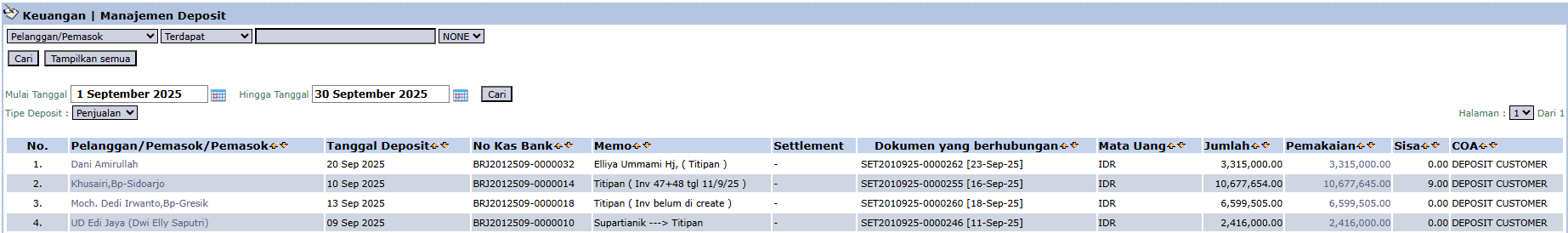

1. Main View (Deposit List)

The main page of this module displays a list of all deposit transactions recorded in the system.

View Explanation & Filters

This page is for viewing and monitoring all deposit transactions.

-

Filters:

-

Customer/Supplier: Use this filter to search for deposits from or to a specific party.

-

Deposit Type: A key filter to select the type of deposit to be viewed, for example, Sales (for deposits from customers) or Purchasing (for deposits to suppliers).

-

Start Date / End Date: Use this filter to screen deposits based on a specific date range.

Column Explanation

The table below will display all deposits that match the filters, with important columns such as:

-

Customer/Supplier: The name of the party associated with the deposit.

-

Deposit Date: The date the deposit was recorded.

-

Amount: The initial value of the deposit.

-

Usage: The amount of the deposit that has already been used or applied to an invoice.

-

Remaining: The remaining balance of the deposit that is still available.

-

COA: The Chart of Account linked to the deposit.

2. Workflow & Integrated Business Process

-

This is a reporting and inquiry module. Deposit data is not created or modified here.

-

Customer deposit data is recorded via the Bank/Cash Receipt modules.

-

Supplier deposit data is recorded via the Bank/Cash Disbursement modules.

-

This Deposit Management module consolidates all of that data into one centralized view for easy monitoring.

Tips & Important Notes

-

Use this report to monitor the unused deposit balances from all customers or to all vendors.

-

The Remaining column is an important indicator of a liability (for customer deposits) or an asset (for deposits to vendors) that the company still holds.

-

This is an important monitoring report for the Finance and Accounting teams.