Skip to main content

Account Receivable Mutation Detail

Report Module Guide: Account Receivable Mutation Detail

Module Location

Accounts Receivable > Reports > Account Receivable Mutation Detail

Module Objective

The Account Receivable Mutation Detail report module is used to generate a highly detailed accounts receivable mutation report with various advanced filter options. This report is designed for in-depth analysis and complex customer account reconciliations, including the ability to display related payable or deposit transactions.

1. Report Parameters

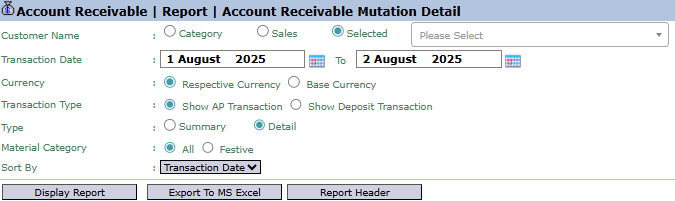

The main page of this module is a form containing various parameters to customize the report that will be generated.

Here is an explanation for each parameter:

-

Customer Name:

-

Filter data by customer in various ways: Category, Sales (Salesman), or Selected (to choose one specific customer).

-

Transaction Date:

-

Specify the From and To date range to define the mutation period to be displayed (e.g., August 1, 2025, to August 2, 2025).

-

Transaction Type:

-

A special filter to include other types of transactions in the receivables report:

-

Show AP Transaction: To display accounts payable (AP) transactions that could potentially be offset (netted) against the receivable.

-

Show Deposit Transaction: To display deposit or down payment transactions from the customer.

-

Type:

-

Select the report's level of detail: Summary or Detail.

-

Sort By:

-

Choose the criteria for sorting the data on the report, for example, by Transaction Date.

-

Other Filters:

-

Other filters such as Currency and Material Category are available to further narrow down the report results.

2. Steps to Generate the Report

Step 1: Set Report Parameters

Select all the combinations of parameters you need to generate a highly specific report according to your analysis needs.

Step 2: Generate the Report

After all parameters are set, click one of the buttons in the bottom-left section of the page:

-

Display Report: To preview the report directly on your screen.

-

Export To MS Excel: To download the report data in an Excel file format.

Tips & Important Notes

-

Use this report for in-depth analysis or for complex reconciliation cases where you need to see related payable (AP) or deposit transactions from the customer.

-

The Sort By feature helps you organize the data for easier analysis, for example, by sorting by transaction date.

-

This report is a powerful analysis tool for the Accounts Receivable (AR) and Credit Control teams.