Skip to main content

Reversible Journal

Detailed Module Guide: ReversingReversible Journal

Module Location

General Ledger > ReversingReversible Journal

Module Objective

The Reversing Journal module is a specific accounting tool used to create a journal entry at the beginning of a new accounting period that is the exact opposite of an adjusting journal entry made at the end of the previous period. Its purpose is to simplify the recording of transactions in the new period, especially for transactions related to accruals (accrued expenses or accrued revenue).

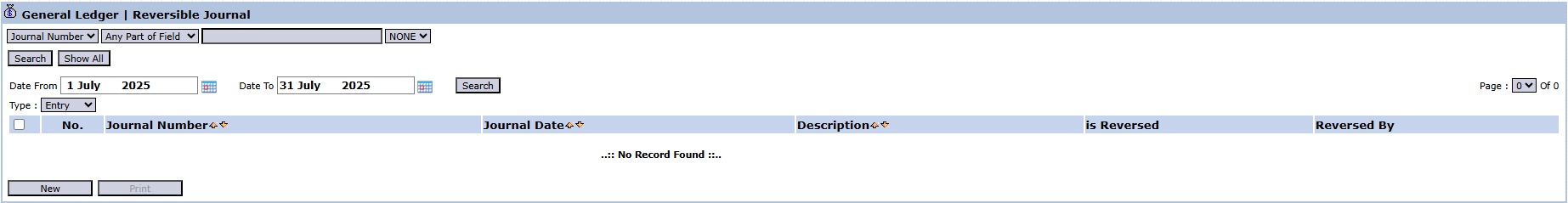

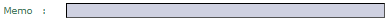

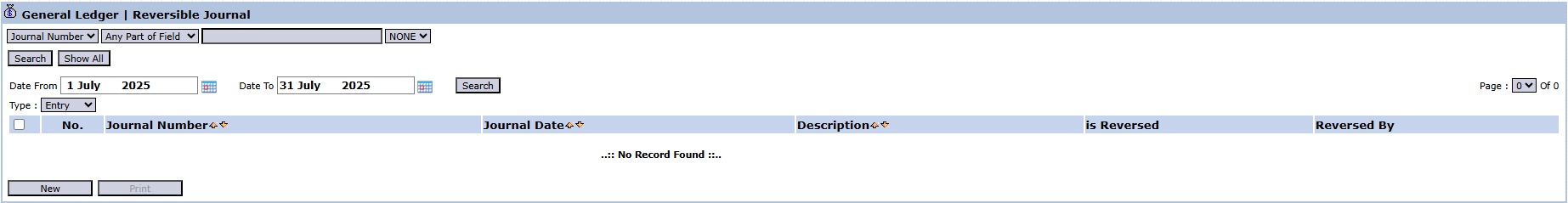

1. Main View (Reversing Journal List)

The main page of this module displays a list of all Reversing Journals that have been created.

View Explanation

This page is the central hub for viewing and managing all recorded reversing journals.

-

Filters: You can search for journals by Journal Number, Type, or a Start Date and End Date range.

-

Journal List: The table below will display a summary of each reversing journal entry. Its columns include Journal Number, Journal Date, Description, Reversed (status), and Reversed By (username).

-

New: The primary button to start the process of creating a new Reversing Journal.

-

Print: To print the voucher for a selected reversing journal.

2. Steps to Create a Reversing Journal

The process of creating a Reversing Journal is different from a General Journal, as you do not manually input debits and credits, but rather select an existing journal to be reversed.

Step 1: Click the "New" Button

From the main view, click the New

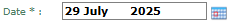

Step 2: Fill in the Header Information

-

Date: Important! Enter the start date of the new accounting period. For example, if you want to reverse an adjusting journal from July 31, 2025, you should enter the date August 1, 2025.

-

Memo: Provide a clear description, for example, "Reversing Journal for July 2025 Accrued Salary Expense".

-

Project / Currency: Fill in if relevant to the transaction being reversed.

Step 3: Select the Journal to be Reversed

This is the most crucial step. The system will display a list of journals (likely adjusting entries from the previous period) in the detail table below.

-

Find and locate the journal entry you wish to reverse from the available list.

-

Check the box on the left of the corresponding journal row to select it. You can select one or more journals to be reversed simultaneously.

Step 4: Save the Reversing Journal

After the journal(s) to be reversed have been selected:

-

Click the Save button. The system will automatically create a new journal entry with debit and credit positions that are the reverse of the original journal you selected.

-

Reset: To clear your selections and start over.

-

Back to Index Page: To cancel the process and return to the main view.

Tips & Important Notes

-

This module is an advanced accounting tool. Use it only to reverse accrual-type adjusting entries. Do not use it to correct errors (use the General Journal for corrections).

-

The key to this process is selecting the correct Date, which is the first day of the next accounting period.

-

This process simplifies work. For example, after reversing an accrued salary expense, the Accounting team can record the actual salary payment in the new period by debiting the salary expense account normally, without needing to split the journal entry.