Aged Receivables Average

Report Module Guide: Average Aged Receivables

Module Location

Accounts Receivable > Reports > Average Aged Receivables

Module Objective

The Average Aged Receivables report module is used to calculate a key financial metric: the average collection period or Days Sales Outstanding (DSO). This report shows, on average, how many days it takes for the company to receive payment from customers after a sale is made. It is a key indicator for measuring the efficiency of the collections process.

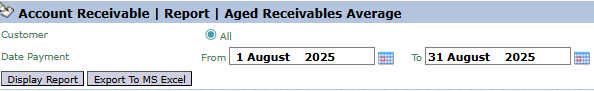

1. Report Parameters

The main page of this module is a simple form containing several parameters to generate the report.